mississippi income tax rate 2020

Tax rate of 4 on taxable income between 5001 and 10000. Tax rate of 4 on taxable income between 5001 and 10000.

State Corporate Income Tax Rates And Brackets Tax Foundation

Important tips to help expedite processing of your return.

. Taxable and Deductible Items. Mississippi State Tax Quick Facts. Integrate Vertex seamlessly to the systems you already use.

27-7-5 and 27-7-18 Beginning with tax year 2018 the 3 income tax rate will be phased out over a five-year period. Mississippi Code at Lexis Publishing Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1. 0 on the first 2000 of taxable income 3 on the next 3000 of taxable income 4 on the next 5000 of taxable income 5 on all taxable income over 10000.

Mississippi income tax rate 2020. This page has the latest Mississippi brackets and tax rates plus a Mississippi income tax calculator. Mississippi Salary Tax Calculator for the Tax Year 202223.

TY 2019 2020. Ad Compare Your 2022 Tax Bracket vs. Senate Bill 2858 2016 Legislative Session - Miss.

Mississippi has a graduated tax rate. The graduated income tax rate is. Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition.

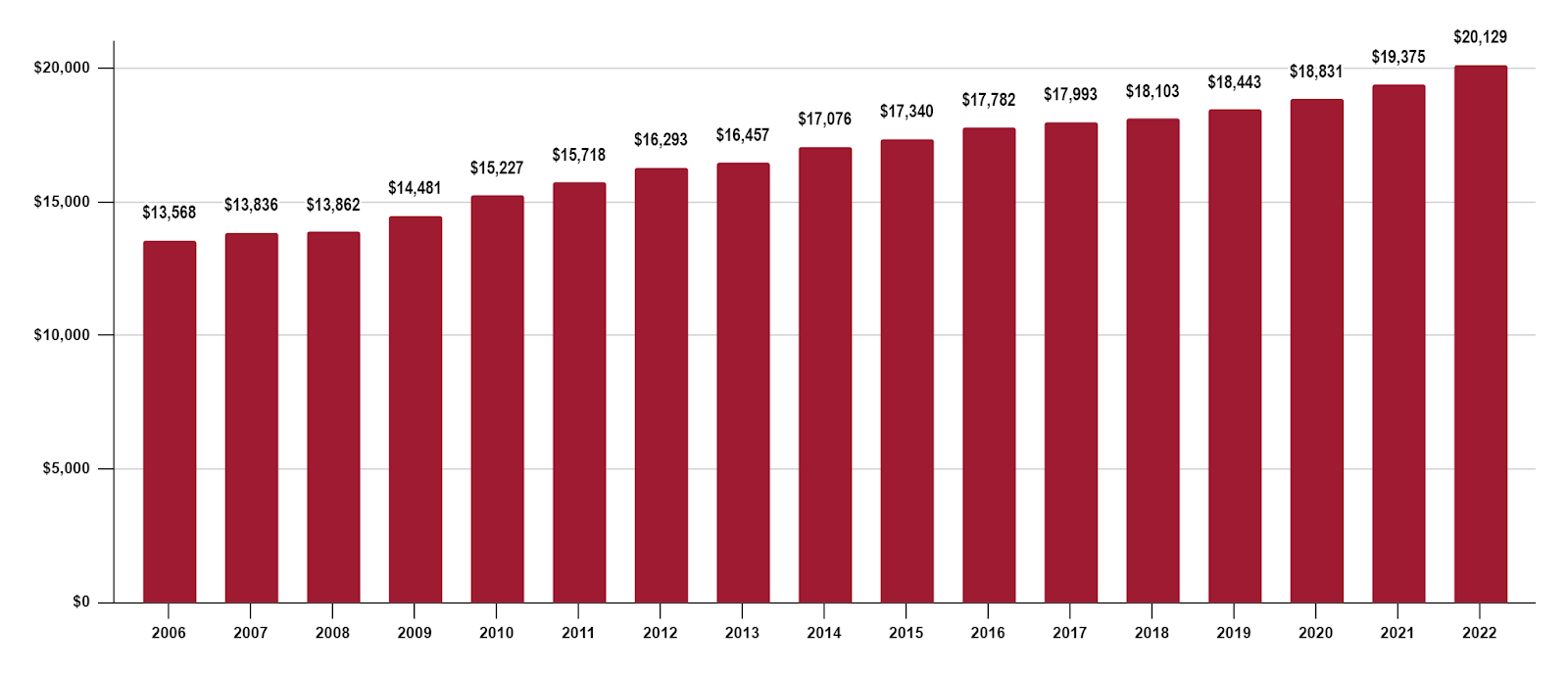

For married taxpayers living and working in the state of Mississippi. The average family pays 136000 in Mississippi income taxes. Median gross rent 2016-2020.

601 923-7094 Electronic Filing 2021 Approved Providers for E-File 2020 Approved Providers for E-File 2019 Approved Providers for E-File 2018 Approved Providers for E-File 2017 Approved Providers for E-File Electronic Filing E-File Online Access. Senate Bill 2858 2016 Legislative Session - Miss. Mississippi Governor Tate Reeves R in his budget proposal for fiscal year FY 2022 has announced his goal of phasing out the states income tax by 2030.

Individual Income Tax Notices. Does Mississippi have a minimum corporate income tax. You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202223.

Tax rate of 0 on the first 5000 of taxable income. You will be taxed 3 on any earnings between 2001 and 5000 4 on the next 5000 up to 10000 and 5 on income over 10000. 079 average effective rate.

All other income tax returns P. Tax Rates Exemptions Deductions. Mississippi has a graduated income tax rate and is computed as follows.

Median value of owner-occupied housing units 2016-2020. Median selected monthly owner costs -with a mortgage 2016-2020. 5 on all taxable income over 10000.

Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. For single taxpayers living and working in the state of Mississippi. The tax rate reduction is as follows.

How to Calculate 2020 Mississippi State Income Tax by Using State Income Tax Table 1. Check the 2020 Mississippi state tax rate and the rules to calculate state income tax 5. Owner-occupied housing unit rate 2016-2020.

Our calculator has been specially developed. However if you owe taxes and dont pay on time you might face late tax payment penalties. Mississippi has a graduated income tax rate and is computed as follows.

There is no tax schedule for Mississippi income taxes. Find your income exemptions 2. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Mississippi Tax Brackets for Tax Year 2020 Tax Rate Income Range Taxes Due 0 0 - 3000 0 within Bracket 3 3001 - 5000 3 within Bracket 4 5001 - 10000 4 within Bracket 5 10001 5 over 10000 2020 Mississippi Standard Deductions Tax Year Status Amount 2021 SingleMFSHOH 2300 Married Jointly 4600 2020 SingleMFSHOH 2300. The 2020 COVID-19 Mississippi Business Assistance Act. These rates are the same for individuals and businesses.

0 on the first 3000 of taxable income. Mississippis income tax currently has three marginal rates of 3 percent 4 percent and 5 percent. 27-7-5 and 27-7-18 Beginning with tax year 2018 the 3 tax rate on corporate income tax will be phased out over a five-year period ending with tax.

Mississippi has 3 state income tax rates. Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket. Income tax tables and other tax information is sourced from the Mississippi Department of Revenue.

The 2020 COVID-19 Mississippi Business Assistance Act. The corporate rates and brackets match the individual rates and brackets and the. Explore The Top 2 of On-Demand Finance Pros.

What is Mississippi State Income Tax rate 2020. Discover Helpful Information and Resources on Taxes From AARP. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001.

Find your pretax deductions including 401K flexible account contributions. Mississippis 2022 income tax ranges from 3 to 5. Median selected monthly owner costs -without a mortgage 2016-2020.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. 28th out of 51 Download Mississippi Tax Information Sheet Launch Mississippi Income Tax Calculator 1. Mississippi Income Tax Table Learn how marginal tax brackets work 2.

3 on the next 2000 of taxable income. Find your gross income 4. 4 on the next 5000 of taxable income.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Your 2021 Tax Bracket to See Whats Been Adjusted. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time.

Hurricane Katrina Information Resources. Corporate and Partnership Income Tax Help Corporate Income Tax Division. Ad See If You Qualify To File For Free With TurboTax Free Edition.

079 average effective rate. Tax Year 2019 Mississippi Income Tax Brackets. Tax rate of 5 on taxable income over 10000.

Mississippi Income Tax Calculator How To Use This Calculator. How do I compute the income tax due.

Here Is Whats On The Economic Calendar In Asia Today Fed Speaker Speaker Bank Of Japan Asia

Mississippi Income Tax Calculator Smartasset

How Do State And Local Sales Taxes Work Tax Policy Center

Tax Rates Exemptions Deductions Dor

How Long Has It Been Since Your State Raised Its Gas Tax Itep

1983 Wyoming License Plate 32931 License Plate Funny Gifts For Dad Natrona County

Tour Ben And Erin Napier S House Home Town House Tour In Laurel Mississippi Home Town Hgtv Hgtv Master Bedrooms Home

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Tua On Injury Concern I M Not Playing Badminton National Football League National Football Football Activity

What Will My Career In Massage Therapy Look Like Infographicbee Com Massage Therapy Massage Therapy School Massage Therapy Career

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi Tax Rate H R Block

Mississippi Income Tax Calculator Smartasset

Mississippi Tax Rate H R Block

Tax Rates Exemptions Deductions Dor

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog